Accountant’s Reports: When are Residual Balances a Red Flag?

Solicitors handling client money (with limited exceptions) are required to obtain an accountant's report each year. This article considers situations where an accountant might need to issue a "qualified" report due to residual balances - highlighting behaviour with a firm that may pose a risk to client money.

When should reports be qualified?

When reviewing a firm's adherence to the Accounts Rules, accountants are required to use their professional judgement to determine if a qualified report is necessary.

The Solicitors Regulation Authority (SRA) only expects reports to be qualified in cases of severe breaches of the Accounts Rules, where client or third-party funds are currently, previously, or potentially at risk.

Accountants Obligations

Reporting accountants are under a statutory duty to immediately report to the SRA:

- any evidence of theft or fraud in relation to money held by a solicitor or a law firm for a client or any other person or in a client account or an account operated by the solicitor

- if they have concerns about whether a solicitor or a law firm is fit and proper to hold money for clients or third parties or operate any such accounts

Scope of Assessment

The SRA only requires reporting accountants to assess compliance with certain provisions of the Accounts Rules:

- Client accounts and their uses

- Withdrawals from a client account

- Duty to correct breaches upon discovery

- Client accounting systems and controls

- Operation of joint accounts

- Operation of a client's own account

- Storage and retention of accounting records

When might residual balances lead to a qualification being necessary?

The SRA classifies factors that could lead to a qualification as either ‘serious’ or ‘moderate’.

Serious factors include examples such as evidence of disregard for the safety of client money, or the failure to complete bank account reconciliations. The presence of one or more of the factors is likely to lead to a qualification.

Longstanding residual balances are seen as a moderate factor. The presence of one or more moderate factors may lead to a qualification depending on the context surrounding the factor.

Because longstanding residual balances are often symptomatic of wider moderate factors - such as a poor control environment and reconciliation processes, the combination of factors may lead to a qualification.

The Impact of a Qualified Accountant’s Report

A qualified report acts as an alert to the SRA that a firm potentially has issues with how it handles client money. This will likely prompt the SRA to look more closely at the issues and ensure the firm takes corrective actions to safeguard client funds.

Poor management of residual balances may also trigger an SRA investigation, which can be both traumatic and time-consuming for staff, and could result in reputational damage and fines for the firm.

If a firm is struggling to return residual balances due to an absence of client details held on file, it could also be viewed by the SRA as deficiency in the management of the firm, and therefore a breach of the SRA Code of Conduct.

When are Residual Balances a Red Flag?

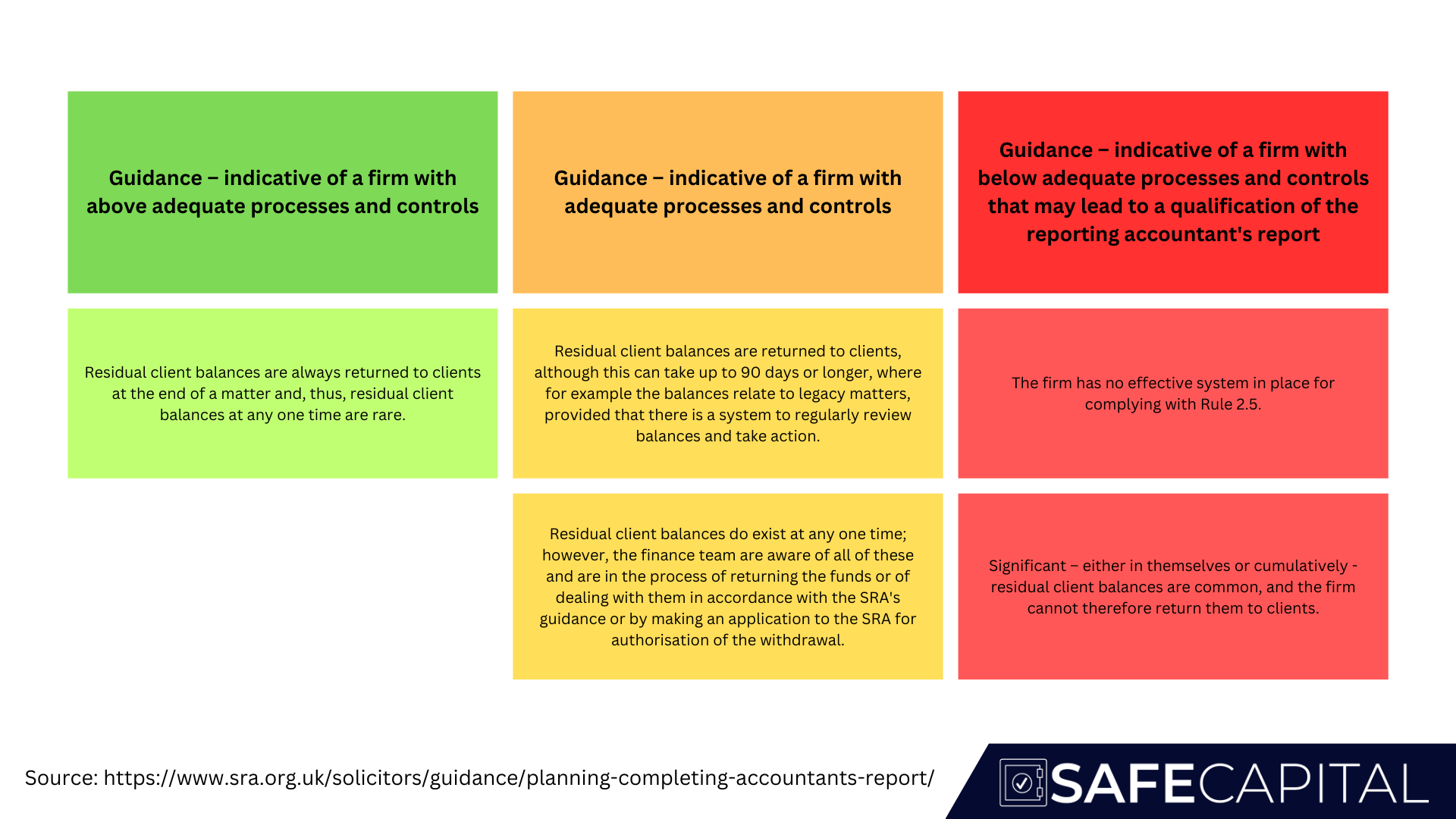

The SRA has provided guidance on what the areas of focus are likely to be for reporting accountants looking to assess whether client money is being returned promptly at the end of a matter (in line with Rule 2.5).

The guidance is intended to assist reporting accountants, the firm's COFA as well as other parties examining compliance with the Accounts Rules. Examples of above adequate, adequate and below adequate processes and controls for handling residual balances are given - below adequate processes and controls may lead to a qualification of the report.

3.9 - Failure to account

Have you seen evidence of the firm failing to return client money promptly at the end of the matter?

General guidance

Residual client balances should be returned promptly to clients at the end of a matter. Where this is not possible, there is clear documentation retained which supports the efforts made to return residual client balances.

Examples of areas of focus

Test the exception report of residual client balances to check that the firm has complied with the rules.

If no exception report exists, obtain a listing of client matters with balances where no time has been charged for a significant period of time and assess if residual client balances exist and the firm has complied with the rules.

Managing Residual Balances

As the SRA guidance notes, having processes and controls in place to manage residual balances effectively is a key component of complying with the Accounts Rules and avoiding the possibility of a qualified report being required.

We help law firms manage and clear residual balances, as well as put processes in place to help prevent them in future.

Contact us today to arrange a demo >>

Conclusion

Accountant’s reports play a vital role in protecting client money. By understanding when residual balances and other factors can trigger a qualified report, both solicitors and accountants can work together to ensure client funds are managed responsibly and without risk.

About Safe Capital

Safe Capital makes it simple for law firms to request, receive or return client money swiftly, safely and securely.

Share & Receive Bank Details Securely- Obtain verified bank account details for each client

- Share your client account bank details securely

- Transfer client money promptly at the end of a matter

- Record your residual balances and take steps to return them

- Automate the process of obtaining bank details from your clients

- Return residual balances easily to your clients

- Swift and secure client payments with one consistent payment workflow for your clients

- Clients can pay by open banking, credit/debit card or manual bank transfer

- Keep client account details away from money launderers and protect clients from payment fraud