Request, receive or return client money swiftly, safely and securely

As featured in the Law Society's Cyber Security Toolkit

"Consider using a tool such as 'Safe Capital' to verify bank details before any funds are exchanged."- Verifying bank details checklist (p27)

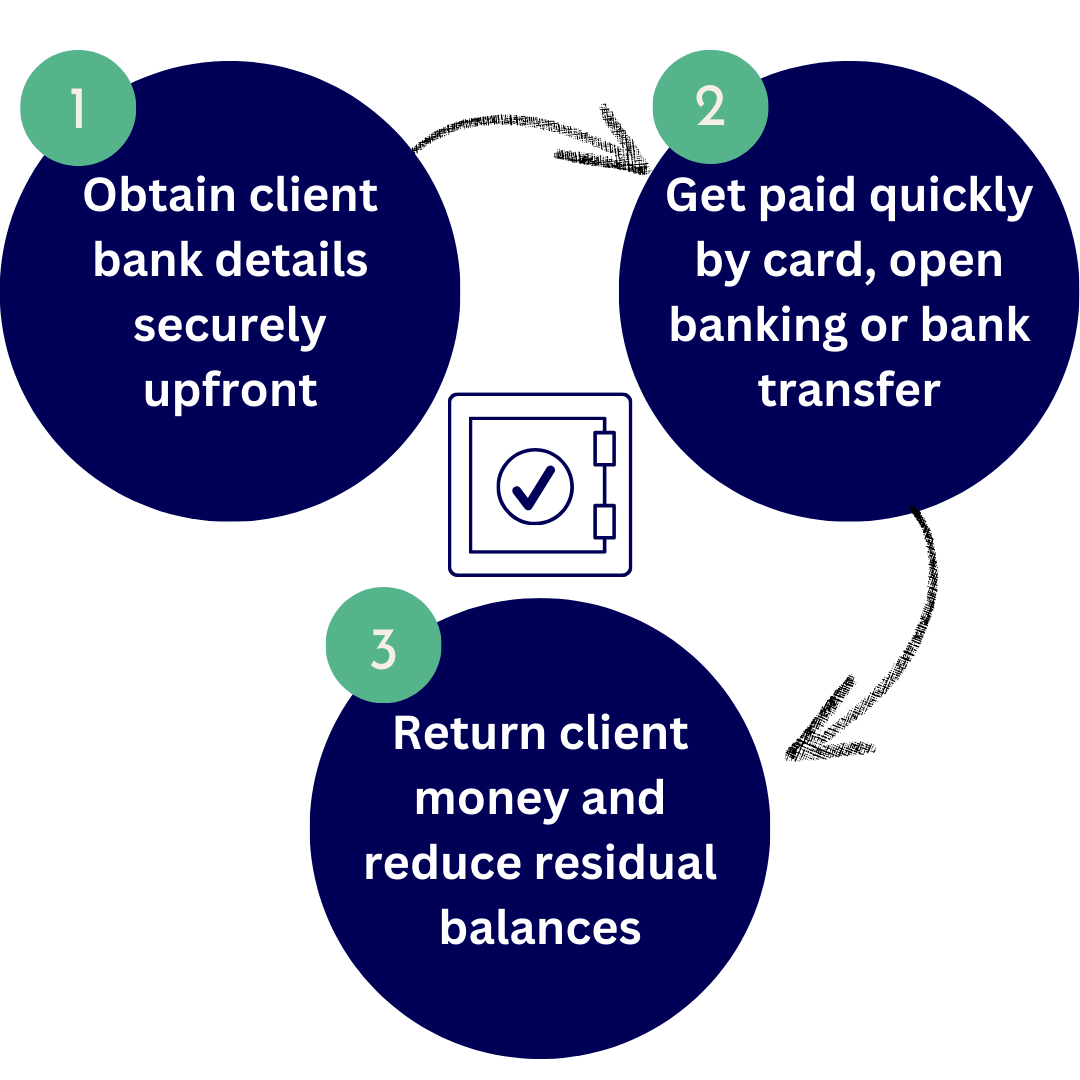

Swift Secure Client Payments

- Swift and secure client payments with one consistent payment workflow for your clients

- Clients can pay by open banking, credit/debit card or manual bank transfer

- Keep client account details away from money launderers and protect clients from payment fraud

Verified Client Bank Details

- Obtain verified bank account details for each client at the outset of each matter

- Reduce the risk of criminals pretending to be your client and supplying false details

- Return client monies easily if a matter fails to complete or you have surplus funds at the end

Residual Balance Management & Reduction

- Complete register of your residual balances, with detailed history of the steps taken to return funds to your clients

- Variety of workflows for contacting clients, depending on the size of the balance and contact information available

- Auto generation of forms and letters, including DWP Forwarding, SRA withdrawal authorisation requests and charity indemnities

PDF White Paper: Beyond Card Payments & Bank Transfers

Benefits of open banking for requesting and capturing payments for law firms

EXTERNAL Supplier Spotlight - Safe Capital

Safe Capital featured in Conveyancer Insights Supplier Spotlight

PDF White Paper: Open Banking for AML and Fraud Prevention

Reducing the dual threats of money laundering and payment fraud with open banking